Why People Invest in Gold

Gold has captivated the human imagination for thousands of years. Across empires and economies, it has retained its status as a symbol of wealth, power, and permanence. In the modern era, gold remains a cornerstone of financial strategy for many investors. It is widely recognized as a hedge against inflation, a safe haven asset during times of economic distress, and a powerful tool for portfolio diversification.

Illustration 1: Gold has been a status assets as far back as ancient Egypt

Perhaps the most striking testament to gold’s enduring value is a comparison drawn across 2,000 years of history: the salary of a Roman soldier, paid in gold coins, was roughly equivalent in gold weight to what a modern Western soldier earns in a year today.

While currencies have changed, empires have fallen, and financial systems have been overhauled, the amount of gold needed to sustain a soldier’s life, covering food, clothing, weapons, and shelter, has remained nearly constant. This suggests that gold has not increased in value over time but has rather preserved value while paper currencies have steadily lost purchasing power.

One of the primary reasons investors turn to gold is its historical role in preserving wealth during periods of inflation or currency devaluation. Unlike paper money, which can be printed at will by central banks, gold has a finite supply and cannot be created by decree. This scarcity lends it intrinsic value. When the purchasing power of fiat currencies declines, whether due to loose monetary policy, excessive debt, or political instability, gold tends to hold its value, and often appreciates.

Illustration 2: The amount of gold a Roman Soldier got was equal to the amount of money of a modern soldier

Gold is also considered a safe haven asset. In times of geopolitical tension, banking crises, or stock market meltdowns, investors often rush to gold for security.

Illustration 3: Gold bars, popular as a safe heaven

It is not tied to the solvency of governments or the profitability of corporations, making it uniquely resilient during systemic shocks. Furthermore, gold exhibits low correlation with traditional financial assets like stocks and bonds, making it an excellent tool for portfolio diversification.

Another appealing aspect of gold is its tangibility. In a world of digital finance and intangible investments, gold is a real, physical asset that one can touch, store, and pass down through generations. This physicality, combined with universal recognition, makes gold a uniquely trusted asset.

Owning Physical Gold: Coins, Bars, and Bullion

The most direct way to invest in gold is by purchasing physical gold. This includes coins, bars, and bullion that you own outright. Gold coins, such as the American Gold Eagle, the Canadian Maple Leaf, and the South African Krugerrand, are popular among investors due to their government minting and international recognition. These coins usually come in sizes ranging from one-tenth of an ounce to one full ounce and are often made of 22-karat or 24-karat gold.

Illustration 4: A Canadian Maple Leaf gold coin, one of the most popular gold coins.

For those looking to make larger investments, gold bars or ingots may be more efficient. These come in a wide range of weights, from small 1-gram bars to the standard 400-ounce “Good Delivery” bars used by central banks and bullion vaults. Larger bars typically carry lower premiums per gram compared to coins, making them more cost-effective for serious investors.

It’s important to understand the distinction between bullion and numismatic coins. Bullion refers to gold purchased for its metal content, whereas numismatic coins are collectible items that carry additional value due to their rarity, historical significance, or artistic design. For most investors, bullion is preferable because its value is more directly tied to the market price of gold and it is easier to sell.

It is also worth that based on the country you live in, it can have different tax consequences if you invest in a gold coin or bar. In a lot of countries gold coins are exempt from tax while gold bars are not.

:max_bytes(150000):strip_icc()/closeup-of-big-gold-nugget-511603038-5ad92a97fa6bcc00362b919b.jpg)

Illustration 5: Raw gold

How to Buy Physical Gold

When purchasing physical gold, it is essential to buy from reputable sources. Authorized dealers, both online and in-person, often offer competitive prices and authentication guarantees. They are usually certified by national mints or international associations such as the London Bullion Market Association (LBMA). Online platforms like APMEX, Kitco, and JM Bullion also offer wide selections, secure shipping, and customer support.

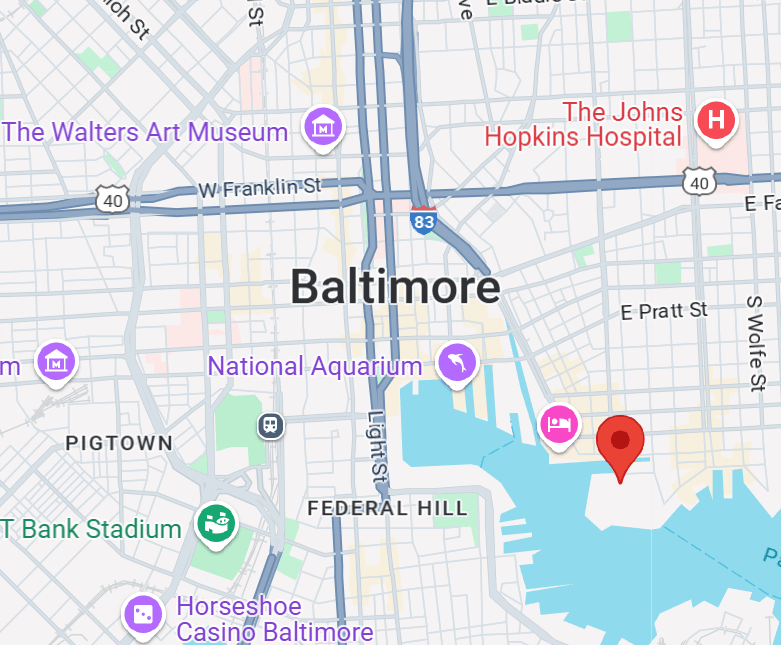

In some countries, the central banks or national mints do sell gold bullion, coins, or bars directly to individuals. Examples include: The Monetary Authority of Singapore has previously supported gold programs (e.g. via UOB), and retail banks may offer gold products, The Swiss National Bank does not sell gold, but the Swiss Mint (controlled by the Swiss government) sells commemorative and bullion coins.

The Austrian Mint (a subsidiary of the central bank, Oesterreichische Nationalbank) sells gold coins like the Vienna Philharmonic directly to the public, The Royal Canadian Mint, a Crown corporation, sells gold bars and coins such as the Gold Maple Leaf via its website and authorized dealers, the South African Reserve Bank previously issued Krugerrands but now works through subsidiaries and dealers.

Illustration 6: The Royal Canadian Mint which sells gold through their website

Some banks and financial institutions also sell gold, particularly in countries where gold ownership is more common. However, these offerings are typically limited and may come with higher premiums. Private transactions, such as those conducted through pawn shops or local dealers, carry a higher risk of counterfeiting or overpricing, and should only be conducted with thorough due diligence.

When buying gold, investors should also be aware of pricing terms. The gold “spot price” is the live price for one troy ounce of gold on the global market. Dealers typically charge a premium over this price to cover fabrication, handling, and profit margin.

Storing Physical Gold: Options and Considerations

Once purchased, physical gold must be stored safely. Home storage is a common method, especially for smaller holdings. This typically involves using a secure, fireproof safe and keeping the gold in a discreet location. While home storage provides direct access to your assets, it also entails security risks, including theft and fire, and may not be fully covered by standard homeowner’s insurance.

Another common option is storing gold in a safe deposit box at a bank. While this offers higher security, access can be restricted during bank closures or crises, and the contents may not be insured unless specifically arranged.

Another option is third-party professional storage. Private vault companies such as Brinks, Loomis, and ViaMat offer high-security, fully insured storage solutions. These facilities often provide allocated storage, where specific bars or coins are held in your name, or unallocated storage, where you hold a claim to a pool of gold. Allocated storage is safer, though often more expensive.

Illustration 7: A fireproof home safe can be a good option for securing gold.

Gold ETFs: Investing Without Holding Gold

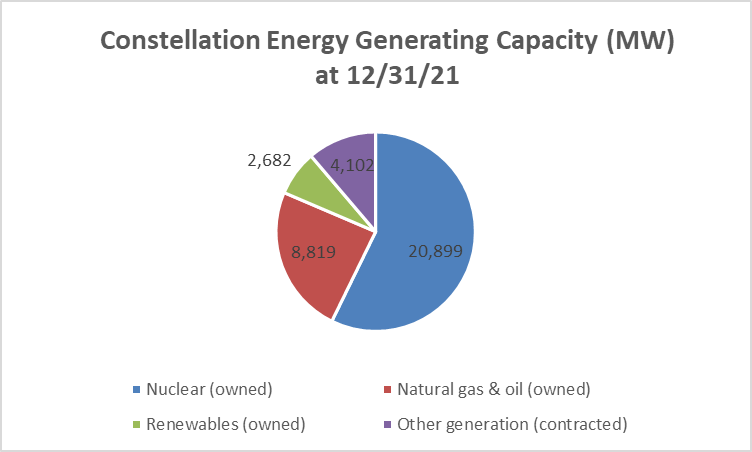

For investors who prefer not to deal with the logistics of physical gold, gold exchange-traded funds (ETFs) offer a highly convenient alternative. These financial instruments allow you to invest in gold without owning the metal directly. Gold ETFs, like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), are backed by physical gold stored in vaults. When you purchase shares of the ETF, you effectively own a fractional claim on the fund’s gold holdings.

Illustration 8: Gold ETFs such as IShares Gold Trust can be a good option for those not wanting to invest in physical gold.

Gold ETFs can be bought and sold just like stocks, making them extremely liquid and easy to manage through a regular brokerage account. They are suitable for both short-term traders and long-term investors. However, they do carry management fees, which slightly erode returns over time. Moreover, they come with counterparty risks, including potential issues with the fund’s custodians or administrators.

It is also important to distinguish between physically-backed ETFs and synthetic ETFs. The former hold real gold in vaults, while the latter use derivatives to replicate gold’s price movements. Synthetic ETFs are generally riskier and less transparent, making them unsuitable for conservative investors.

Gold Mining Stocks and Investment Funds

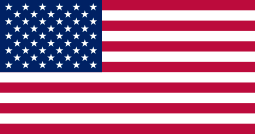

Another popular way to gain exposure to gold is through investments in gold mining companies. Shares of companies like Barrick Gold, Newmont Corporation, and AngloGold Ashanti are traded on stock exchanges and often rise or fall in line with gold prices. Mining companies offer leveraged exposure to gold. When gold prices rise, the profits of mining companies can grow significantly due to fixed costs and expanding margins.

Illustration 9: A Gold mine in the US

However, investing in mining stocks introduces new variables, including operational risks, labor disputes, environmental liabilities, and political instability in mining regions. Junior miners, small exploration firms seeking new deposits, offer even greater potential returns but they are often highly volatile and speculative. In other words, you are also exposed to the company itself and not only the commodity gold when investing in a gold mining company.

For investors who want diversified exposure to the mining sector, there are mutual funds and ETFs that track baskets of gold mining stocks. The VanEck Gold Miners ETF (GDX) focuses on large, established firms, while the Junior Gold Miners ETF (GDXJ) targets smaller, more speculative companies.

What Drives Gold Prices: Supply, Demand, and Macro Forces

The price of gold is influenced by a complex interplay of supply and demand dynamics, as well as broader macroeconomic forces. Meaning that as most other assets its price is simply made out of supply and demand. On the demand side, jewelry remains the largest use case for gold, especially in countries like India and China, where gold holds deep cultural and ceremonial significance. Investment demand also plays a major role, including purchases by individuals, institutions, and sovereign wealth funds.

Illustration 10: India is a large market for gold

Central banks are key players in the gold market. Many, particularly in emerging markets, have increased their gold reserves in recent years to diversify away from the U.S. dollar and protect against economic sanctions or currency instability. While gold also has limited use in electronics, medicine, and aerospace, these industrial applications make up a small portion of total demand.

On the supply side, gold primarily comes from mining. The process is capital-intensive and slow; bringing a new mine to production can take over a decade. Ore grades have been declining in many regions, and regulatory hurdles are growing, all of which constrain supply. Recycling, mostly from jewelry and electronic waste, contributes a secondary source of gold but is highly sensitive to price movements and economic conditions.

Macro variables like interest rates, inflation, and the U.S. dollar have a powerful influence on gold. Gold does not yield income, so when interest rates are high, investors may prefer bonds or savings accounts. Conversely, when real interest rates (adjusted for inflation) are low or negative, gold becomes more attractive. Inflation generally supports higher gold prices, especially when it undermines confidence in fiat currencies. Additionally, gold tends to move inversely to the U.S. dollar. A strong dollar can suppress gold prices, while a weakening dollar often lifts them.

Geopolitical risk also affects gold. Events such as wars, terrorist attacks, trade conflicts, or financial system disruptions tend to drive investors toward gold. In times of crisis, gold’s appeal as a neutral, apolitical, and tangible asset becomes particularly strong.

Illustration 11: Geopolitical uncertainty such as war can lead to greater gold price.

The top ten largest consumers of gold are 1. China, 2. India, 3. US, 4. Turkey, 5. UAE, 6. Russia, 7. Saudi Arabia, 8. Iran, 9. Egypt and 10. Indonesia. While the largest suppliers of gold are 1. China, 2. Russia, 3. Australia, 4. US, 5. Canada, 6. Peru, 7. Ghana, 8. South Africa, 9. Mexico and 10. Brazil.

Risks and Tax Considerations

Despite its benefits, gold is not a risk-free investment. It can be volatile, especially in the short term. It does not generate cash flow like stocks or bonds. Physical gold requires secure storage and insurance. ETFs and mining stocks involve counterparty risk and market risk, respectively.

Furthermore, gold investments can be taxed in various ways. In some countries, profits from selling gold are subject to capital gains taxes. Some jurisdictions charge VAT or sales tax on gold purchases, unless the items qualify as investment-grade bullion. Wealth taxes and reporting requirements may also apply. Consulting a qualified tax advisor is always recommended.

Illustration 12: Gold is more liquid than other precious metals

How Gold Compares to Other Precious Metals

Gold is often grouped with silver, platinum, and palladium, but it plays a unique role. Silver has significant industrial uses and tends to be more volatile. Platinum and palladium are primarily industrial metals used in automotive emissions control and can be highly cyclical.

Gold, by contrast, is overwhelmingly held for monetary and investment purposes. It is the most stable and globally recognized of the precious metals, and its market is the deepest and most liquid.

Common Investment Strategies Involving Gold

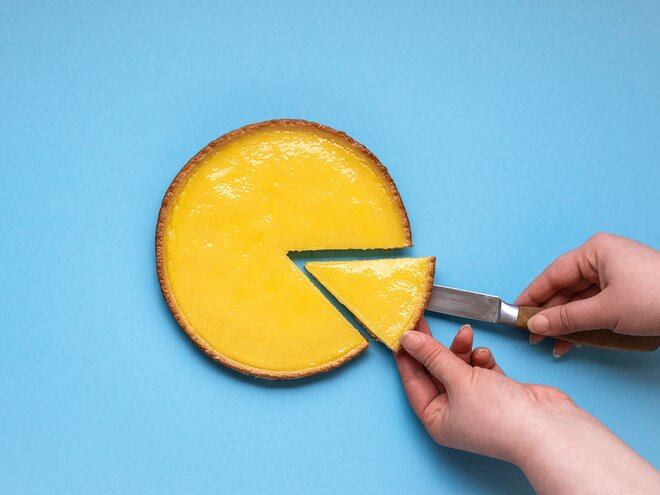

Investors approach gold in various ways. A long-term strategic allocation of five to ten percent is common among those looking to hedge against systemic risk or inflation. Some investors increase their gold holdings tactically during periods of geopolitical tension or economic uncertainty.

Illustration 13: It can be a good idea to make sure 5-10% of your portfolio consists of gold to hedge against inflation.

Others use gold as a short-term trading instrument, relying on technical analysis or macroeconomic trends. More advanced strategies include trading based on the gold-silver ratio, or investing in both physical gold and mining equities to capture both stability and upside.

Understanding the Gold Market and How Prices Work

To understand gold as an investment, one must first grasp how the gold market functions. The gold spot price represents the current price at which one ounce of gold can be bought or sold for immediate delivery.

This price is driven by trading activity on international exchanges and is typically quoted in U.S. dollars per troy ounce.

Illustration 14: COMEX in New York

Futures markets, such as those operated by the COMEX in New York, allow investors to speculate on gold prices at future dates. These contracts are a major source of short-term price discovery and can create volatility due to their leverage and large volume of speculative interest. The London Bullion Market Association (LBMA) also plays a crucial role, setting a benchmark price known as the “London Fix” twice daily. This price is used globally by jewelers, refiners, and central banks.

Conclusion: Is Gold Right for You?

Gold has earned its reputation as a reliable store of value and a key component of sound financial planning. Whether you are preparing for inflation, seeking protection from geopolitical turmoil, or simply looking to diversify your portfolio, gold offers a compelling set of characteristics.

However, it is not a silver bullet. Like any investment, it requires careful planning, proper storage or custodianship, awareness of market dynamics, and consideration of personal risk tolerance.

With its historical significance, universal appeal, and resistance to monetary debasement, gold continues to play a vital role in the financial strategies of individuals, institutions, and nations alike. Whether you hold it in your hands, store it in a vault, or track it on your screen, gold remains as it has for thousands of years a symbol of wealth, security, and enduring value.

Warren Buffet on Gold

Legendary investor Warren Buffett has consistently expressed a negative view of gold as an investment. He argues that gold is an unproductive asset, it doesn’t generate earnings, pay dividends, or contribute to economic growth. In his view, gold simply “sits there,” and its value relies largely on investor sentiment and fear rather than intrinsic or productive utility.

Buffett prefers investments in businesses, farmland, or real estate which are assets that produce income and compound over time. In a well-known example, he compared the entire world’s gold stock to the same dollar value invested in U.S. farmland and ExxonMobil, concluding that the latter would clearly deliver greater long-term returns. Although Berkshire Hathaway briefly held a small stake in Barrick Gold (a mining company) in 2020, Buffett has never supported owning gold itself. His core belief remains unchanged: productive assets create real wealth, while gold does not.